In a recent legal twist, Tesla shareholders have taken a dramatic step, filing a lawsuit against CEO Elon Musk. This lawsuit claims that Musk’s latest venture, the artificial intelligence company xAI, is not just another business endeavor but a direct competitor to Tesla’s own AI projects. The lawsuit accuses Musk of breaching his fiduciary duty to Tesla by diverting resources and focus from the company to his new startup. Here’s an in-depth look at the situation, its implications, and what it means for Tesla and Musk’s empire.

The Genesis of xAI

Elon Musk officially unveiled xAI in 2024, positioning it as a groundbreaking initiative aimed at developing safe and advanced artificial intelligence technologies. Musk’s vision for xAI is to create a platform that rivals OpenAI, the organization he co-founded but later distanced himself from due to disagreements over its direction and commercialization.

The core of the lawsuit hinges on the argument that xAI’s objectives overlap significantly with Tesla’s own AI-driven initiatives, particularly in the realm of autonomous driving. Tesla’s Autopilot and Full Self-Driving (FSD) technologies are key components of its future growth strategy. Shareholders argue that Musk’s involvement in xAI represents a conflict of interest, potentially siphoning off talent, resources, and intellectual property from Tesla.

The Shareholders’ Perspective

From the shareholders’ point of view, Musk’s dual roles pose a significant threat to Tesla’s competitive edge. They argue that Musk’s extensive involvement in xAI could lead to a diversion of his attention from Tesla, where his focus is critically needed. They also fear that Musk might prioritize xAI over Tesla, especially if the new venture starts showing promising results.

According to the lawsuit, Musk has breached his fiduciary duty by creating a competitor to Tesla. They claim this not only jeopardizes the company’s AI projects but also dilutes Musk’s commitment to Tesla’s success. The lawsuit seeks to prevent Musk from using Tesla’s resources, including intellectual property and personnel, to benefit xAI.

The Legal Arguments

The legal battle centers around several key arguments:

- Fiduciary Duty: Shareholders assert that Musk, as the CEO of Tesla, has a fiduciary duty to act in the best interests of the company and its shareholders. By starting xAI, they argue, Musk has created a conflict of interest that violates this duty.

- Intellectual Property: The lawsuit raises concerns that proprietary technology and know-how developed at Tesla could be transferred to xAI, either directly or indirectly.

- Resource Allocation: There is apprehension about the allocation of human and financial resources. The plaintiffs contend that critical resources may be diverted from Tesla to support Musk’s new venture.

- Focus and Commitment: Shareholders are worried that Musk’s involvement in xAI could lead to a lack of focus on Tesla’s core business operations, impacting its performance and market position.

Musk’s Defense

Elon Musk has not publicly responded to the lawsuit in detail, but his legal team is expected to argue that xAI and Tesla are fundamentally different enterprises. They might contend that while Tesla focuses on applying AI to specific industries like automotive and energy, xAI’s broader mandate to develop general AI technologies does not directly compete with Tesla’s business model.

Furthermore, Musk’s team is likely to argue that his ventures have historically benefited from cross-pollination of ideas and technologies. They may cite examples of how advancements in one of Musk’s companies, such as SpaceX, have positively impacted others, including Tesla.

Implications for Tesla

The outcome of this lawsuit could have profound implications for Tesla. If the court rules in favor of the shareholders, Musk might be forced to sever his ties with xAI or implement strict measures to ensure a clear separation of resources and intellectual property between the two entities.

A ruling against Musk could also lead to heightened scrutiny of his management practices and governance structure at Tesla. This might prompt the company to establish more robust safeguards to prevent potential conflicts of interest in the future.

The Broader Impact on Musk’s Ventures

Musk’s entrepreneurial endeavors are characterized by their ambitious scope and interconnectivity. Companies like SpaceX, Tesla, Neuralink, and now xAI, often benefit from shared innovations and a collaborative approach. This lawsuit could set a precedent that affects how Musk manages his diverse portfolio of companies.

If Musk is forced to distance himself from xAI, it could slow down the progress of the new venture or necessitate finding new leadership capable of driving its ambitious agenda. On the other hand, a resolution that allows Musk to maintain his involvement in both companies might necessitate clearer boundaries and operational distinctions to mitigate shareholder concerns.

Market Reactions

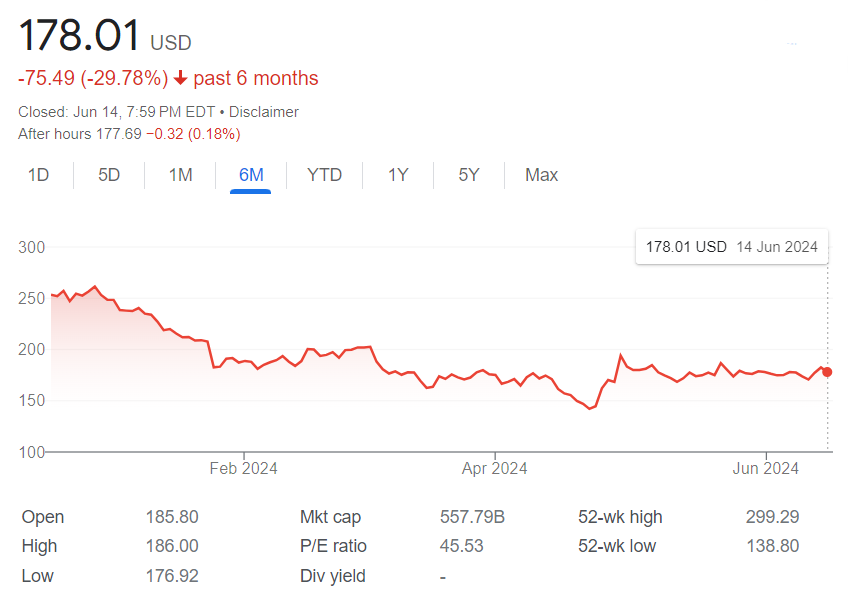

The lawsuit has already caused ripples in the stock market, with Tesla shares experiencing increased volatility. Investors are closely watching the developments, as the legal battle could influence Tesla’s strategic direction and market valuation. A protracted legal fight could also impact investor confidence, potentially leading to a reevaluation of Tesla’s stock.

Expert Opinions

Legal and industry experts have weighed in on the lawsuit, offering a range of perspectives:

- Corporate Governance Experts: Some experts argue that the lawsuit highlights the need for stronger corporate governance at Tesla. They believe that clearer guidelines and oversight mechanisms could help prevent such conflicts of interest.

- AI Industry Analysts: Analysts in the AI sector are divided on whether xAI poses a real threat to Tesla. Some believe that the distinct focus areas of the two companies mean that competition is minimal, while others caution that any overlap could be detrimental to Tesla’s leadership in automotive AI.

- Market Strategists: Financial strategists suggest that the lawsuit could lead to greater scrutiny of how Musk balances his responsibilities across his various ventures. They recommend that Tesla establish more transparent communication channels with shareholders regarding Musk’s commitments.

Future Prospects

Regardless of the lawsuit’s outcome, the situation underscores the complexities of managing multiple high-stakes ventures in cutting-edge industries. For Musk, who is known for his visionary approach and relentless drive, finding a balance between his diverse interests will be crucial.

For Tesla, maintaining its leadership in the electric vehicle and AI markets will require continued innovation and a clear strategic focus. The company’s ability to navigate this legal challenge and reassure shareholders will be key to sustaining its momentum and growth.

Conclusion

The lawsuit filed by Tesla shareholders against Elon Musk over his new AI venture xAI represents a critical juncture for the company and its CEO. The legal arguments focus on fiduciary duty, potential conflicts of interest, and the allocation of resources. As the case unfolds, it will not only impact Tesla and xAI but also set important precedents for corporate governance and the management of multi-industry ventures. The tech and financial worlds will be watching closely as this high-stakes drama plays out, potentially reshaping the landscape of Musk’s empire and the future of AI innovation.

For more detailed updates on the lawsuit and its implications, you can read the full article on The Verge.